After sharing the mysteries of “Inner and Outer Consistency” and “Inner and Outer Inconsistency” in economic phenomena last time, I received many private messages from friends. Today, we will delve deeper into the “inner and outer logic” hidden behind economic phenomena and policies.

For instance, in the case of the popular new energy vehicle industry in recent years, we often see government officials and business leaders frequently visiting new energy vehicle companies, attending development seminars and so-called summit forums related to the industry.

Subsequently, various media outlets report and interpret this phenomenon, discussing what important signals it “releases”.

In no time, various interpretations and viewpoints emerge in the market; some say this indicates that the government is about to introduce more substantial subsidy policies to encourage car manufacturers to expand production; others believe it is guiding capital to flood into the sector, accelerating industry development and consolidation.

In reality, this seemingly bustling and suggestive scene often resembles a game of “guess what, guess what”.

Faced with such economic phenomena, most of the time we find it difficult to see through the intentions behind them at a glance. After all, these so-called “important signals” often present an “inner and outer inconsistency” rather than a clear “inner and outer consistency”.

Looking at the real estate market regulation, the history of real estate regulation over the past 20 years is essentially a history of “inner and outer logic”.

When housing prices in certain cities fluctuate to a certain extent, relevant government officials go to inspect new projects in that area or hold discussions with large real estate developers.

Once the news is released, many self-media outlets begin to signal whether the purchase restrictions will be loosened or if mortgage rates are about to undergo significant adjustments; or which area is about to rise, with the government planning to invest heavily in that region.

Thus, these “important signals” generate attention and create a rhythm, leaving many people in a fog.

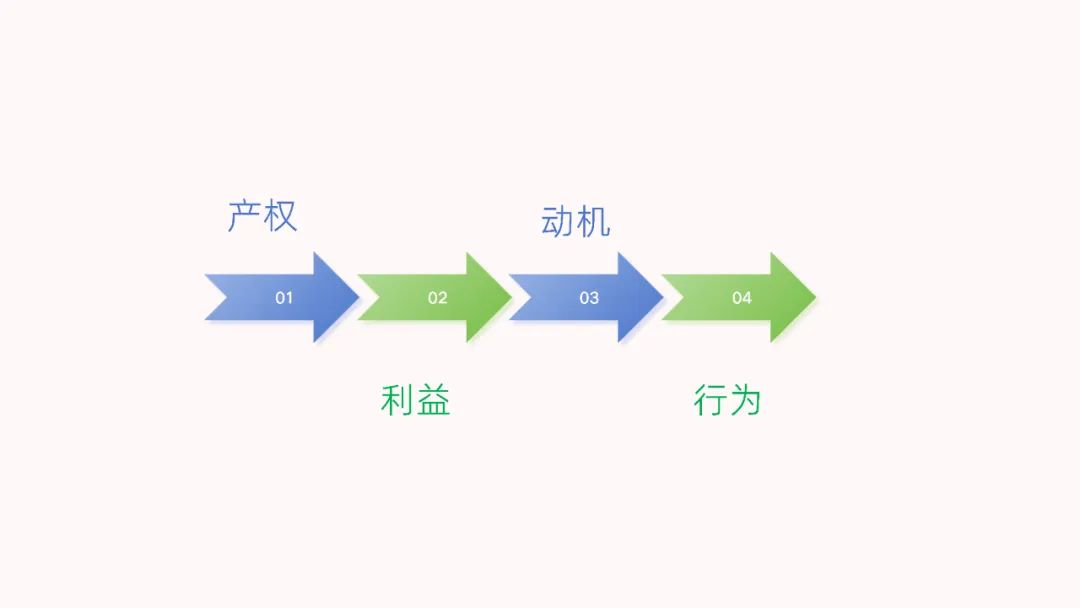

Today, we return to the RSPCP economic analysis framework, firmly believing that all economic phenomena should be discussed based on the core premise and underlying logic of property rights (Right).

Because property rights define the allocation of interests, which in turn drives motives and behaviors, and behavior is the external manifestation of motives; this analytical logic is of utmost importance.

Therefore, regardless of the observation object or the signals released, we should focus on one point: whose property rights are behind this economic phenomenon? Property rights determine whose interests are being served, and thus many complex phenomena will become clear.

Only by firmly grasping the key premise and essence of property rights (Right) can we accurately discern the true demands and internal needs, thereby thoroughly understanding the “inner and outer consistency” and “inner and outer inconsistency” in economic phenomena.

In 2016, the Harvard Business Review published an excellent article titled “Discovering Customers’ True Needs through Value Elements”, which analyzes the underlying logic of the needs of individuals, enterprises, and governments very well. I also recommend everyone to read it when they have time.

Author Wang Lei (SansWang) is a senior market strategy consultant, business columnist, and Pu’er tea collector. His views represent personal opinions and do not constitute investment advice.The “RSPCP Economic Analysis Model” is an economic analysis framework proposed by the author, which will be published in a globally renowned business media in 2024; Wang Lei (SansWang) has published several business column articles on Forbes, Fortune Chinese website, and World Manager.